If you are a UKG Workforce Central user, you may have a superpower in your pocket yet to be discovered. Thanks to a subtle but effective update in WFC 8.1, you can easily streamline your Prorated Accruals process.

Before this update, WFC users had to view multiple grants and create workarounds with their policies to prorate an employee's grant based on their date of hire. In some cases, managers and UKG admins worked with multiple accrual policies to handle employees getting prorated accruals.

This WFC 8.1 update will allow managers and admins to adjust accrual grants based on an employee's date of hire, date of termination, or other relevant employment events. It also enables automatic recalculation of accruals based on specific career events, such as promotion, change to full-time employee status, or employment contract modifications.

Here's How

The Prorated Accruals includes options to adjust and recalculate accrual grants and balances to provide users the flexibility to configure an accrual policy that grants accruals to employees based on different conditions.

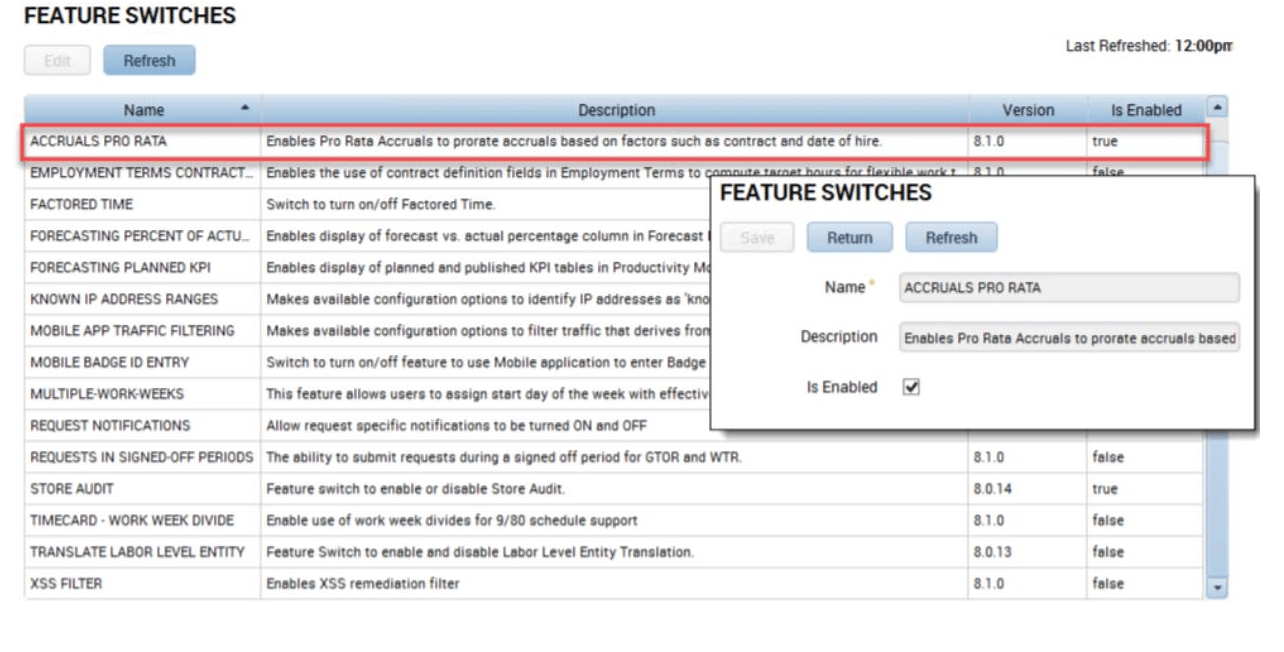

Step 1: Feature Switches

Review Feature Switches and look for Accruals Pro Rata feature

Enable the Accruals Pro Rata feature (see graphic)

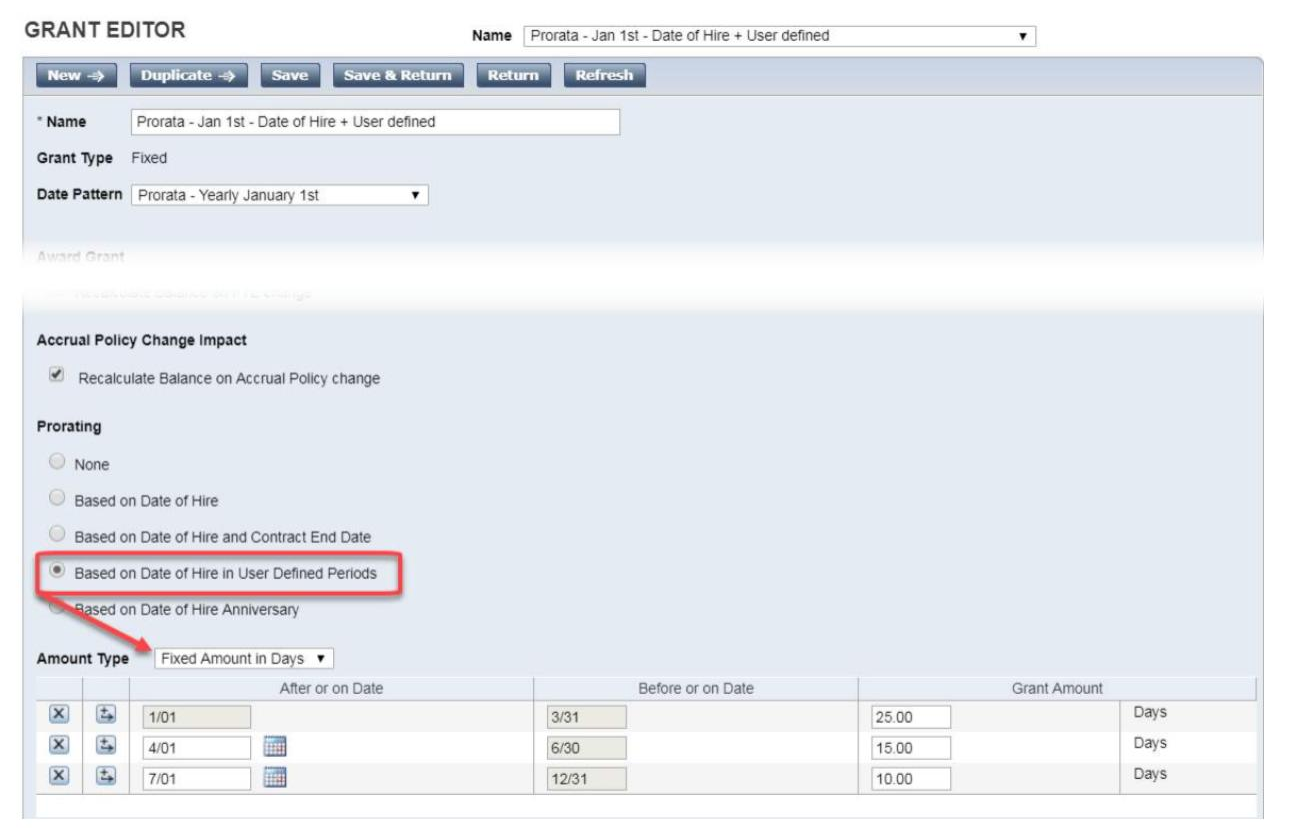

Step 2: Grant Editor

Once Accruals Pro Rata has been enabled you can leverage the new tools in the setup of Accrual Grants.

New Options have been added to the Grant Editor in the Accruals part of the setup.

These options are related directly to proration

These options allow you to prorate based on:

· Date of Hire

· Date of Hire and Contract End Date

· Date of Hire in User Defined Periods

· Date of Hire Anniversary

Examples

Date of Hire

Company offers a grant of 30 Days PTO on January 1st

Employee is hired April 1st and receives 22.6

Grant Amount / (days in year) x (days from DOH to December 31st)

(30) / (365) x (275 (days from April 1st to Dec 31st)) = 22.6

This can also be done on a monthly level to determine how many hours an employee should get based on the day in the month.

Date of Hire and Contract End Date

The previous example applies here. The difference is in the calculation rather than calculating the number of days from the date of hire to the end of the year, it would calculate to the end of the contract

Date of Hire in User Defined Periods

This example is what appears to be the most useful as it allows us to list out different date ranges in the grant itself and determine how many hours would be granted.

Rather than calculating the amount the grant would give the amount entered

Date of Hire & Amount of Grant

Jan 1-Mar 31 = 25 Days

Apr 1-Jun 30 = 15 Days

Jul 1-Dec 31 = 10 days

Based on Date of Hire Anniversary

This option allows us to run the same calculations seen in the previous examples but only go into effect once the employee has reached their anniversary date of hire.

You are also able to control whether or not you want an employee to get a January 1st grant at a new threshold if they will reach the level of service during that year.

Example

0-4 years = 40 Hours PTO

5-9 years = 80 Hours PTO

10+ years = 120 Hours PTO

Hire Date May 9th 2020

Three options for basing on Date of Hire Anniversary

-

On Anniversary Date

You should use this if you have grants that grant on employees Date of Hire rather than 1st of the year grants.

An employee would get 40 hours on their Date of Hire Anniversary.

Employee would begin getting 80 hours on their Date of Hire anniversary beginning May 9th 2025.

Employee would begin getting 120 hours on their Date of Hire anniversary beginning May 9th 2030.

-

On Start of Reference Period Before Anniversary Date

This option and the next are more useful if you are using January 1st grants or another date equivalent.

This option will allow you to award the grant in anticipation of the employee hitting their 5th year.

Employee would begin getting 80 hours on January 1st, 2025 even though they have not yet hit their anniversary date.

-

On Start of Reference Period After Anniversary Date

This option will allow you to award the grant after the employee has hit their 5th year.

Employee would begin getting 80 hours on January 1st, 2026 rather than the year before after they have hit their 5-year anniversary date.

Making the most of your UKG WFC system updates is a powerful way to streamline your processes and empower your frontline managers to accurately manage and report critical data such as Accruals. Get overwhelmed with updates? Improv is here to help.

Optimize Power.

Streamline Processes.

At Improv, our seasoned UKG consultants are here to help you make sense of updates and optimize the powerful tools you own. We can review your existing accruals and recommend a host of ways to align your WFC system with your business goals. Contact us today and let's get started!

We've helped companies big and small amplify their workforce power. Read more about how we saved our friends at TreeTop time, money, and headaches by streamlining their manual processes.

Comments